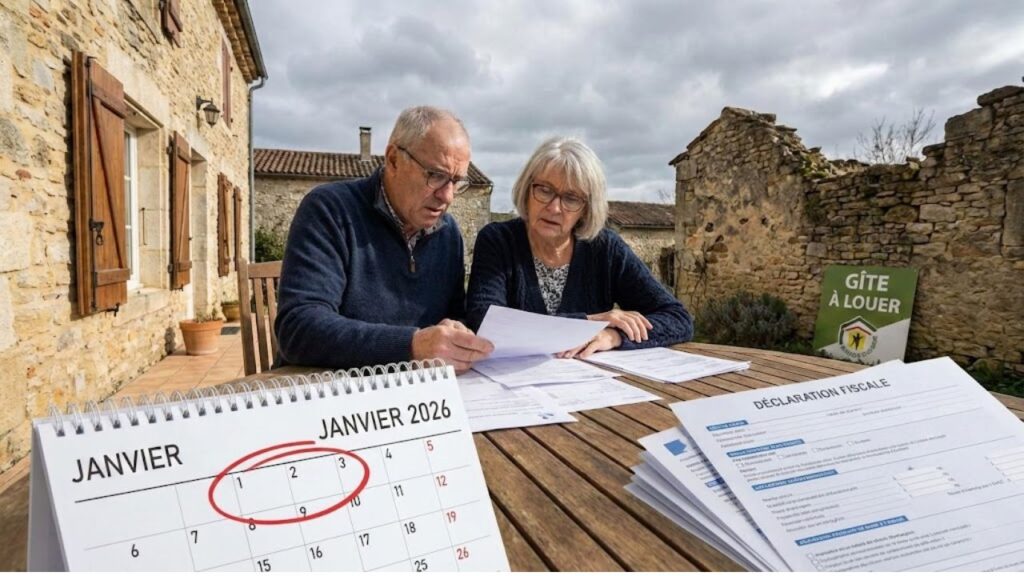

From Paris to the Atlantic coast, owners of short-term rentals who relied on lenient tax rules are bracing for change. A new law, popularly called the “anti-Airbnb” measure, overhauls the taxation of furnished tourist rentals starting with 2025 income. The first impact will be visible when landlords file returns in spring 2026.

A Targeted Crackdown on Holiday Rentals

The reform originates from the Le Meur law, officially passed in November 2024. Its main goal is to encourage short-term rentals to return to the long-term housing market, particularly in areas with high housing pressure.

Previously, non-classified furnished tourist rentals listed on platforms like Airbnb or Abritel enjoyed favorable tax treatment. Under the micro-BIC regime, they benefited from a simplified business income scheme with a generous allowance.

Until 2024 income, hosts could claim a 50% tax allowance on up to €77,700 in annual rental income. Effectively, only half of their rental revenue was subject to income tax and social charges, making short-term letting more profitable than long-term rentals or other investments.

Long-term furnished rentals used as a tenant’s main residence are unaffected, retaining the 50% allowance and €77,700 ceiling. The reform specifically targets short-stay tourist rentals kept out of the long-term market.

What Changes Come into Effect in 2026?

The significant shift in 2026 is the reduction of the tax advantage landlords previously enjoyed. While the law applies from January 1, 2025, the impact is felt when reporting 2025 income in 2026.

For non-classified furnished tourist rentals, two key changes apply:

- The micro-BIC ceiling drops from €77,700 to €15,000 per year.

- The automatic tax allowance falls from 50% to 30% of gross rents.

This double blow means many landlords will exceed the €15,000 threshold and leave the micro-BIC scheme. Those remaining under the ceiling will face a smaller deductible portion of income.

For example, a host earning €20,000 annually will now be taxed on €14,000 instead of €10,000 under micro-BIC, illustrating the substantial increase in taxable income even for modest portfolios.

Micro-BIC vs Real Regime: Understanding the Difference

Under micro-BIC, the tax office applies a flat discount to gross rents without detailed accounting. With the new 30% allowance, 70% of rental income becomes taxable.

The real regime (régime réel), common among LMNP landlords (non-professional furnished landlords), allows deducting actual expenses such as mortgage interest, insurance, property taxes, agency fees, repairs, and utilities. Property and furniture depreciation can also be applied, lowering taxable income without cash leaving the pocket.

Why 2025 Income and 2026 Taxes Are a Turning Point

The French tax authority confirms the timeline: all changes apply to income earned from January 1, 2025, with returns filed in spring 2026. Many owners will face higher tax bills for the first time.

| Type of Rental | Micro-BIC Ceiling (2024) | Allowance (2024) | Micro-BIC Ceiling (2025) | Allowance (2025) |

|---|---|---|---|---|

| Short-term tourist, non-classified | €77,700 | 50% | €15,000 | 30% |

| Furnished main residence (long-term) | €77,700 | 50% | €77,700 | 50% |

The aim is to redirect some properties from tourist rentals to long-term housing. Landlords will need to make strategic decisions in the coming months.

How LMNP Landlords Can Adapt

For LMNP landlords exceeding €15,000 income, the real regime becomes the preferred option. It requires detailed bookkeeping, retention of invoices, and ideally, an accountant familiar with French rental taxation. In return, landlords gain flexibility and often a lower long-term tax burden.

The key consideration is whether actual expenses plus depreciation exceed the 30% flat allowance. If so, staying on micro-BIC offers little benefit.

Option: Classifying Properties as Furnished Tourist Rentals

Another approach is obtaining the official “meublé de tourisme” classification. This allows owners to maintain a more favorable micro-BIC regime with a higher ceiling and 50% allowance. The property must meet strict standards for comfort and equipment, from bedding quality to kitchen facilities. For some, upgrades align with guest expectations; for others, the costs may outweigh the benefits.

Practical Scenarios for 2025 Income

- Small city flat (€12,000/year): Micro-BIC remains viable with €8,400 taxable. Real regime may not yield much extra benefit, but simulations are recommended.

- Coastal holiday home (€25,000/year): Micro-BIC unavailable. Switching to real regime or changing use can reduce taxable profit below €17,500.

- Two-flat portfolio (€40,000/year): Likely heavily affected. Moving to real regime or mixing long-term and short-term rentals becomes a critical business decision.

Key Concepts to Know

- Micro-BIC: Simplified taxation with fixed allowance, no detailed expense deduction.

- LMNP: Non-professional furnished rental status, allowing choice between micro-BIC and real regime.

- Amortisation/Depreciation: Spreads property and furniture value over years, reducing taxable income without cash outlay.

Strategic Considerations for Landlords

Seasonal rental owners must now consider net income after tax, potential local regulations, and community pressures. Acting early in 2025 allows landlords to choose the optimal regime, adjust nights rented, apply for classification, or pivot to long-term rental before 2026 returns are locked in.

Despite the end of generous tax breaks, well-located, properly managed properties can remain profitable under the real regime. Thorough financial planning will separate winners from those merely chasing bookings.