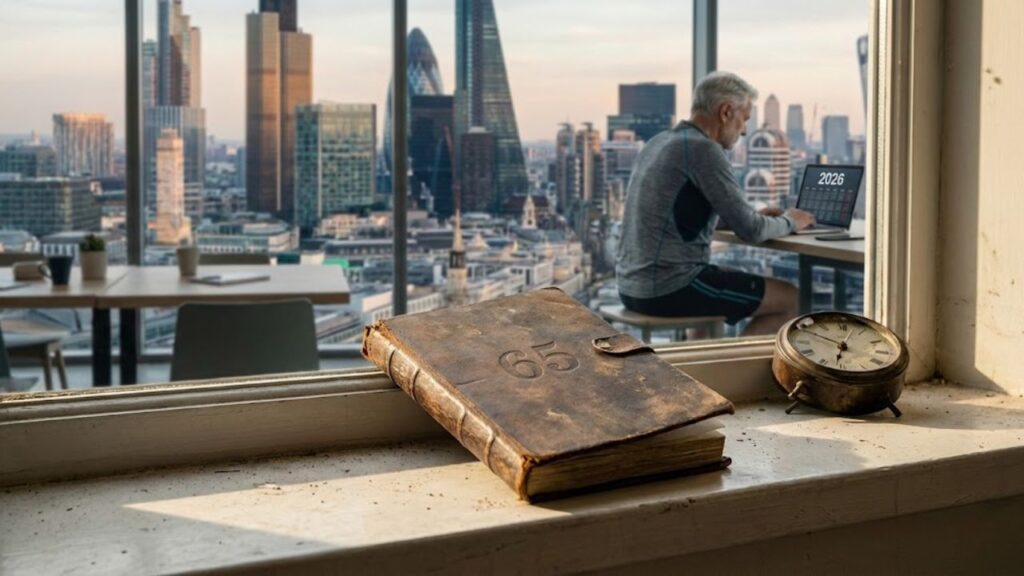

The long-standing idea of retiring at 65 is gradually fading as governments rethink how retirement systems work. In the United States, economic pressures, longer life expectancy, and workforce shortages are pushing policymakers to adjust traditional timelines. By 2026, many Americans will notice that the so-called “standard” retirement age looks different than it did for previous generations. This shift does not mean retirement is disappearing, but it does signal new expectations around work, benefits, and financial planning that affect workers across income levels.

How the Retirement Age Is Changing in 2026

For decades, 65 felt like a fixed milestone, but the retirement age is becoming more flexible in the United States. Social Security rules already reward those who wait longer, and by 2026 this approach becomes even more relevant. Workers are encouraged to stay employed through later benefit access, which can significantly increase monthly payouts. At the same time, employers are adapting to aging workforce trends by offering phased retirement options. While some still choose to exit early with reduced monthly payments, others see value in working longer for higher lifetime income. The change reflects economic reality more than policy shock, reshaping expectations rather than forcing sudden decisions.

Why the New Retirement Age Matters for Workers

The new retirement age matters because it directly affects financial security. As healthcare costs rise, relying solely on savings becomes harder, making longer earning years more appealing. Many workers now plan careers around flexible retirement planning instead of a fixed exit date. Staying employed longer can reduce pressure on personal savings and improve Social Security outcomes through delayed claim advantages. However, not all jobs are physically sustainable, which is why retraining and lighter roles are gaining attention. Overall, the shift rewards preparation and adaptability, especially for those who align work choices with future income stability.

What the New Retirement Age Means for the Economy

Beyond individuals, the retirement age shift has broad economic effects. Keeping experienced workers active supports productivity and eases labor shortages through continued workforce participation. Government programs benefit from reduced benefit strain as payouts are delayed and contributions last longer. Businesses also gain from knowledge retention and mentorship, creating intergenerational workplace balance. On the flip side, younger workers may worry about slower advancement, though expanding industries often offset this. By 2026, economists expect the new approach to support sustainable public finances while gradually redefining what a full career looks like.

Looking Ahead at Retirement After 65

Retirement after 65 is no longer unusual; it is becoming a strategic choice. Rather than a single finish line, retirement now unfolds in stages shaped by health, income, and lifestyle goals. This evolution encourages personalized retirement timelines instead of rigid rules. Those who prepare early can take advantage of greater benefit flexibility and avoid rushed decisions. At the same time, policymakers must ensure protections for workers unable to extend careers. By 2026, the conversation shifts from when to retire to how to retire well, balancing security, purpose, and long-term economic resilience.

| Aspect | Age 65 Model | 2026 Approach |

|---|---|---|

| Standard Retirement Age | Fixed at 65 | Gradually increasing |

| Social Security Benefits | Lower if claimed early | Higher with delayed claims |

| Work Options | Full exit | Phased retirement |

| Economic Impact | Earlier payouts | Longer contributions |

Frequently Asked Questions (FAQs)

1. Is retirement at 65 still allowed?

Yes, but retiring earlier may result in lower monthly benefits.

2. What is the new retirement age in 2026?

There is no single age, but full benefits generally come later than 65.

3. Can I work and collect benefits?

Yes, with certain income limits depending on your age.

4. Does working longer always increase benefits?

In most cases, delayed retirement leads to higher lifetime payouts.