The first clue is usually a tiny buzz in your pocket.

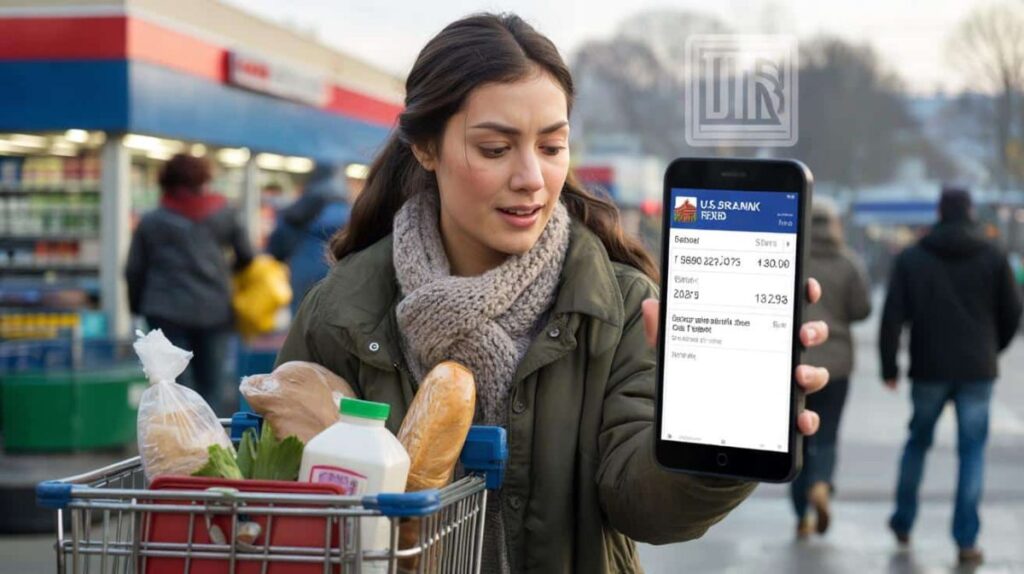

A bank notification, a new balance, a number on a gray screen that suddenly looks… different.

That’s what happened to Maria, a 42‑year‑old home health aide in Ohio, as she sat in her parked car scrolling through emails during a lunch break. Her checking account had just jumped by exactly $2,000. No overtime. No side gig payout. Just a line reading “Federal deposit.”

In group chats and Facebook comments, people are whispering: Is there a new $2,000 direct deposit coming for U.S. citizens in February? Who gets it, and is the IRS involved again like during the stimulus years?

The rumor is loud. The rules are quieter.

$2,000 February direct deposit: what’s real and what’s just wishful thinking

Talk to people standing in line at a grocery store in late January and you’ll hear it: “I heard we’re getting $2,000 again.”

Because once you’ve seen unexpected money land in your account, your brain never quite forgets the feeling.

Some of this buzz comes from old stimulus checks and some from very current things: tax refunds, state-level relief payments, and targeted federal credits that can easily reach or cross the $2,000 mark. When you’re scrolling headlines on your phone, all of that can blur into one big promise.

This is where confusion starts to cost people real opportunities.

Think of James, a single dad in Texas who earned about $36,000 last year.

He filed his tax return early in February, claiming the Child Tax Credit and the Earned Income Tax Credit.

Between his regular refund and those two credits, his expected deposit is just over $2,000. He doesn’t call it a “relief check.”

For him, it’s “the February money” that decides whether he fixes the car or keeps juggling repair lights on the dashboard.

Stories like his are being folded into the rumor of a national $2,000 direct payment, even though what’s coming is mostly tax-driven money, not a brand-new stimulus round voted by Congress.

Here’s the plain truth: there is no blanket, automatic $2,000 February payment for every U.S. citizen.

What there is, is a patchwork of **tax refunds, credits, and state programs** that can easily look like a flat $2,000 if you only glance at the final number on your bank app.

IRS guidance for 2025 tax season is clear on what’s on the table: the Child Tax Credit, the Earned Income Tax Credit, the Recovery Rebate Credit (for people who missed older stimulus), and some smaller targeted provisions.

On top of that, states run their own separate relief programs with their own rules.

Mix it all together, and yes, millions of people will see deposits around that $2,000 mark in February.

Who can hit $2,000 in February – and how the IRS says it actually works

If you’re trying to figure out whether February could bring you $2,000, the most concrete move is simple: run your numbers against the current IRS credit rules.

Not in your head, not on the back of a receipt. With an actual calculator or tax tool.

For families with kids, the Child Tax Credit alone can be a huge chunk of that $2,000.

For workers with lower to moderate earnings, the Earned Income Tax Credit can stack on top and quietly push the total into that magic range.

Direct deposit timing then does the final trick: file early, choose direct deposit, and your money tends to land in February instead of late March or April.

A common trap is assuming citizenship alone unlocks this money. It doesn’t.

Eligibility runs through the IRS rulebook, not your passport.

You generally need:

– A 2024 tax return filed

– A valid Social Security number for credits like the EITC

– Earned income within specific ranges

– Qualifying children that meet residency and relationship tests, if you’re claiming kid-related credits

We’ve all been there, that moment when you half-listen to a friend, think “that sounds right,” and then build your expectations on it.

When it comes to these $2,000 rumors, that’s how people end up disappointed – or filing too late to catch the first direct deposit wave.

For timing, the IRS guidance is surprisingly practical: e‑file, use direct deposit, and your refund generally arrives within 21 days.

Refunds that include the Earned Income Tax Credit and Additional Child Tax Credit are legally held a bit longer each year to combat fraud, which often pushes many of those deposits into the second half of February.

The IRS has said, in plain language, that some taxpayers claiming those credits “should expect refunds by early March” even when they file in January.

So if you’re banking on $2,000 in February, your filing date and which credits you claim matter a lot more than any viral headline promising a specific day.

*The money is real for many people — but the schedule is never as clean as TikTok makes it sound.*

How to prepare so your February deposit is as big – and as fast – as possible

The calmest people in February tend to be the ones who did one small, boring thing in January: they gathered their paperwork early.

W‑2s, 1099s, childcare receipts, student loan statements, even those random letters from the IRS that everyone is tempted to ignore.

The IRS isn’t hiding the playbook.

It publishes income limits, credit amounts, and filing tips on its website, and most tax software now walks you step‑by‑step through the main credits that can build to $2,000 or more.

Filing electronically with direct deposit is still the fastest lane.

If you’re aiming at a February hit, walking a paper return to the post office is basically putting your refund in slow motion.

One quiet money leak is filing in a rush with bad data. Typos in Social Security numbers, missing dependents, a wrong routing number: tiny mistakes that can freeze a refund for weeks.

Let’s be honest: nobody really checks every line with monk‑level focus after a long workday.

This is where free help becomes gold. The IRS‑backed VITA and TCE programs offer in‑person assistance to people below certain income thresholds or over age 60.

They know the credit rules cold, they see the same errors every year, and they can tell you, gently, when your expectations are out of sync with reality.

If $2,000 would change your month, that’s exactly the moment to slow down for an extra half hour of checking.

“People hear ‘$2,000 for everyone’ and walk in angry when their refund is $800,” a volunteer tax preparer in Minnesota told me.

“What they don’t see is that last year they left $600 on the table by not claiming the credits they qualified for.”

- Use **direct deposit** and double‑check your routing and account numbers.

- File electronically, especially if you’re claiming the Earned Income Tax Credit or Child Tax Credit.

- Keep every IRS notice from the last year; bring them to any tax appointment.

- Look up your state’s revenue or treasury website; some have their own $200–$500 relief or credit payments on top.

- Check the official IRS “Where’s My Refund?” tool instead of relying on social media timelines.

The deeper question behind that $2,000: what will you actually do with it?

Once you get past the rumors and the acronyms, the story of a $2,000 direct deposit in February is less about Washington and more about kitchen tables.

For one person it’s finally paying down a credit card that’s been sitting like a stone on their chest. For another, it’s a dental bill, a used car, a month of daycare, a plane ticket to see a parent they haven’t hugged in three years.

The IRS rules won’t remember any of that. You will.

Knowing your real eligibility, your realistic payment window, and your own priorities gives that money a shape before it ever appears in your account.

Some people will scroll, hope, and wait. Others will quietly gather their documents, file early, check official tools, and walk into February with a clearer picture.

If you’re reading this on your phone in a parking lot between shifts, the next move is probably not to search for “secret $2,000 hack,” but to decide what that number would mean for you – and then line up your facts to meet it halfway.

| Key point | Detail | Value for the reader |

|---|---|---|

| Eligibility isn’t automatic | February deposits around $2,000 usually come from tax refunds and credits, not a universal federal payment | Prevents false expectations and focuses you on real IRS rules you can actually use |

| Timing is driven by filing choices | E‑filed returns with direct deposit generally arrive faster; EITC/CTC refunds often land late February or early March | Helps you plan bills, avoid overdrafts, and reduce stress around vague “payment dates” |

| Free help can raise your refund | VITA/TCE and trusted tax tools can spot missed credits and fix common errors | Increases the chance you reach or exceed that $2,000 mark legally and safely |

FAQ:

- Is there a new $2,000 federal stimulus payment for every U.S. citizen in February?No. There is no nationwide, automatic $2,000 stimulus authorized for all citizens. Most $2,000 deposits people are seeing or expecting are regular tax refunds plus credits like the Child Tax Credit or Earned Income Tax Credit.

- Who is most likely to receive around $2,000 by direct deposit?Taxpayers with children claiming the Child Tax Credit, workers eligible for the Earned Income Tax Credit, and people with enough withholding throughout the year often see refunds near or above $2,000, especially when they file early and choose direct deposit.

- When does the IRS say I’ll get my refund if I file in early February?The IRS generally issues refunds within 21 days for accurate e‑filed returns with direct deposit. If you claim the Earned Income Tax Credit or Additional Child Tax Credit, federal law can push your refund to late February or early March.

- Does being a U.S. citizen automatically qualify me for these payments?No. Citizenship alone doesn’t trigger a payment. You must file a tax return and meet the specific income, filing status, and dependent rules for each credit, and in some cases you need a valid Social Security number.

- Where can I get reliable information instead of relying on social media posts?Use the official IRS website, the “Where’s My Refund?” tool, your state revenue department website, and certified tax preparers or IRS‑backed VITA/TCE sites. These sources follow the actual law and current IRS guidance, not rumors.