The story starts with a small field, a few wooden hives and a handshake between neighbours. No contract, no money, just a kind retiree who thinks, “Why leave the land empty when it could feed bees?” For months, he walks past the buzzing boxes with a kind of quiet pride. He’s not a farmer, he’s not selling honey. He’s just lending a corner of his life to something useful and alive.

Then one morning, a letter from the tax office lands in his mailbox. Cold, official and completely out of step with the simplicity of his gesture. “Agricultural land” means “agricultural tax”, even if the only thing he’s harvested is a smile from the beekeeper.

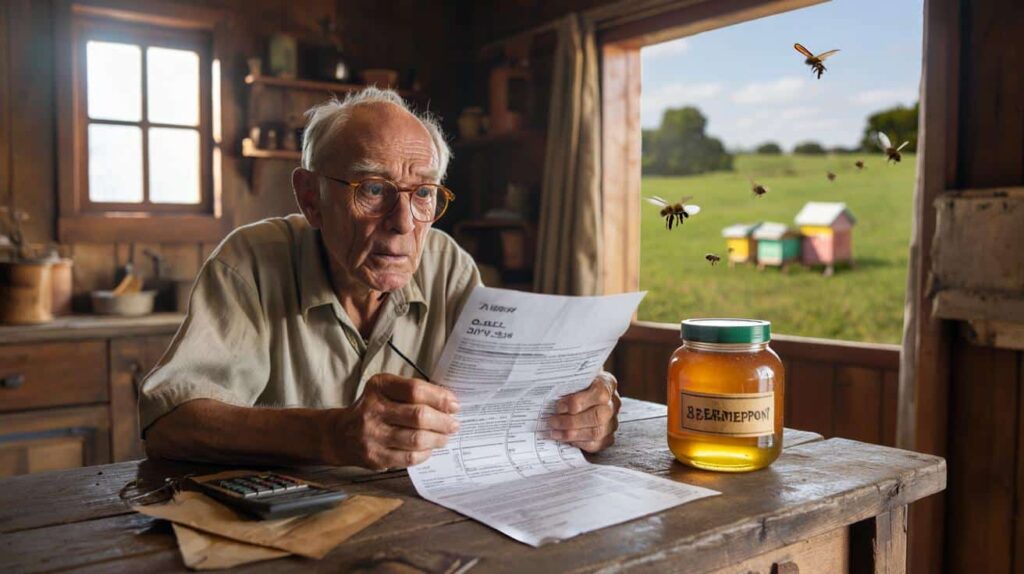

He stares at the bill and hears himself say out loud: “But I’m not making any money from this.”

That’s when the story stops being bucolic. And starts dividing everyone around him.

When a few beehives turn into a tax trap

On paper, the scene looks harmless. A retiree, a patch of land he no longer uses, and a neighbour who keeps bees and needs somewhere to put his hives. No rent, no lease, just a verbal agreement and the feeling of doing something good for nature. Then the taxman shows up in the story, not physically, but with a neat line on a tax assessment: agricultural tax due.

The retiree suddenly discovers that kindness can have a fiscal price. The land, considered “in agricultural use”, switches category. The tax code doesn’t care that he never saw a cent from those bees.

A similar story recently set social media on fire. In a small village, a widower lent two plots to a young beekeeper who couldn’t afford land. Photos of the hives flooded local Facebook groups, everyone praising the initiative. A few months later, the man received a reassessment: agricultural tax plus a small penalty, because the “use of the land had changed”.

He tried to explain at the counter: no rent, no sales, just bees. The clerk shrugged: the use counts, not the profit. The case spread online, becoming a kind of rural fable about rules clashing with common sense. And the comments quickly split in two.

On one side, people shout at the absurdity. “So we punish people who help biodiversity now?” On the other, some quietly remind everyone that land status has always been a serious thing. If a plot is used for farming, broadly speaking, the tax office often reclassifies it, whether there’s a profit or not.

Tax law is built on categories more than feelings. A flower meadow with a deckchair is one thing. A field with productive hives is another in the eyes of the administration. The beekeeper may be the one working, but the owner carries the legal reality on his back. And that’s exactly where the misunderstanding burns the most.

How to help a beekeeper without slipping on the tax banana peel

There is a simple reflex that could save retirees and small landowners a lot of headaches: always clarify, in writing, what you’re doing with your land. Not a 40-page contract, just a short agreement stating who does what, and especially who is responsible for what.

Before a single hive lands on your soil, ask the beekeeper how they usually operate with other landowners. Many professionals already have standard agreements that specify tax and liability issues. One conversation, one sheet of paper, and the “nice little favour” becomes a framed arrangement, not a legal grey zone.

The big mistake many people make is thinking that “no money = no problem”. For the tax authorities, money is not the only signal. Use, duration and nature of the activity matter just as much. Leaving hives for a few weeks in spring isn’t like permanently installing an apiary with dozens of boxes and regular harvests.

If you’ve already lent land “just to help”, you’re not foolish or naive. You’re like most of us who trust a handshake and assume the law will understand. Let’s be honest: nobody really reads every single page of the tax code before saying yes to a neighbour.

Sometimes, the retiree in these stories isn’t angry about paying a bit more tax. What really hurts is the feeling of being treated like a sly businessman when all he did was open a gate.

- Ask your local tax office

Go with a simple map and explain the planned use of the land. Often, a short appointment before the fact avoids a painful surprise later. - Get a basic written agreement

Even a one-page document, dated and signed, outlines the roles of owner and beekeeper. It can show that you are not the operator of the agricultural activity. - Limit the scale of the activity

A few temporary hives for pollination is one thing; a large, permanent apiary is another. The bigger and more structured it looks, the more likely the tax office is to reclassify the land. - Check existing exemptions

Some regions or municipalities support eco-friendly or small-scale agricultural uses. You might not escape the tax, but you could soften the blow. - *Talk about it with your neighbours*

Chances are you’re not the only one wondering about this. Sharing information locally often uncovers practical workarounds people are already using.

A simple act of generosity that raises bigger questions

This story of a retiree, a beekeeper and an unexpected agricultural tax touches a nerve far beyond one village dispute. It questions how our rules treat small gestures of solidarity and ecology. When lending a field to bees is taxed like a full-blown business, some people quietly think twice before saying yes next time. That hesitation, almost invisible, is how good initiatives slowly dry up.

Yet others argue that clear rules also protect land, prevent abuse and keep everyone on equal footing. If someone gains a new use from a property, the community has a say, often through tax. That’s the cold logic behind the bill in the mailbox.

Somewhere between those two visions, real life goes on. Retirees with small plots, young beekeepers trying to start out, neighbours who still prefer a handshake to a folder of PDFs. We’ve all been there, that moment when a simple good deed suddenly feels risky, bureaucratic, almost suspect. It doesn’t mean people will stop helping each other. But they might start asking more questions before they do.

Maybe that’s the quiet lesson here: generosity survives, but it now travels with a pen, a calendar and a quick look at the tax rules.

If you’re reading this with a corner of unused land in mind, you might feel both inspired and wary. You can still host bees, support a small farmer, or lend part of your property for something useful. The difference, today, is doing it with your eyes open. That small, unglamorous step of checking the legal side is what keeps a kind gesture from turning into a bitter story told at the post office counter.

The hives will keep buzzing. The question is under what conditions, and at whose real cost.

| Key point | Detail | Value for the reader |

|---|---|---|

| Clarify land use | Any agricultural activity, even unpaid, can trigger reclassification and agricultural tax | Helps avoid nasty surprises from the tax office after lending land |

| Put agreements in writing | Simple, signed documents describe roles and responsibilities of owner and beekeeper | Reduces misunderstandings and can support your position in case of a dispute |

| Ask before you say yes | Consulting local tax services or a councillor can reveal local rules or exemptions | Lets you help others or support bees while limiting legal and tax risks |

FAQ:

- Can I really be taxed if I don’t earn any money from the hives?Yes, taxation often depends on how the land is used, not just on whether you personally earn income. Agricultural use can lead to agricultural tax even if the beekeeper is the only one selling honey.

- Who is considered the farmer in this situation, me or the beekeeper?It varies by country and local rules. The beekeeper operates the activity, but the landowner can still be affected through land classification and property tax.

- Will a written agreement protect me from agricultural tax?It doesn’t guarantee anything, but it helps clarify that you are not the operator. It’s useful evidence if you need to explain the arrangement to the tax office.

- What if I only host a few hives for a short season?Short, small-scale use is usually less of a problem, but there’s no universal rule. It’s still wise to ask your local tax service how they view seasonal or limited apiaries.

- How can I help a beekeeper without triggering problems?You can limit the number and duration of hives, sign a simple agreement, and consult local authorities beforehand. Some people also prefer symbolic rent or community projects backed by the municipality.