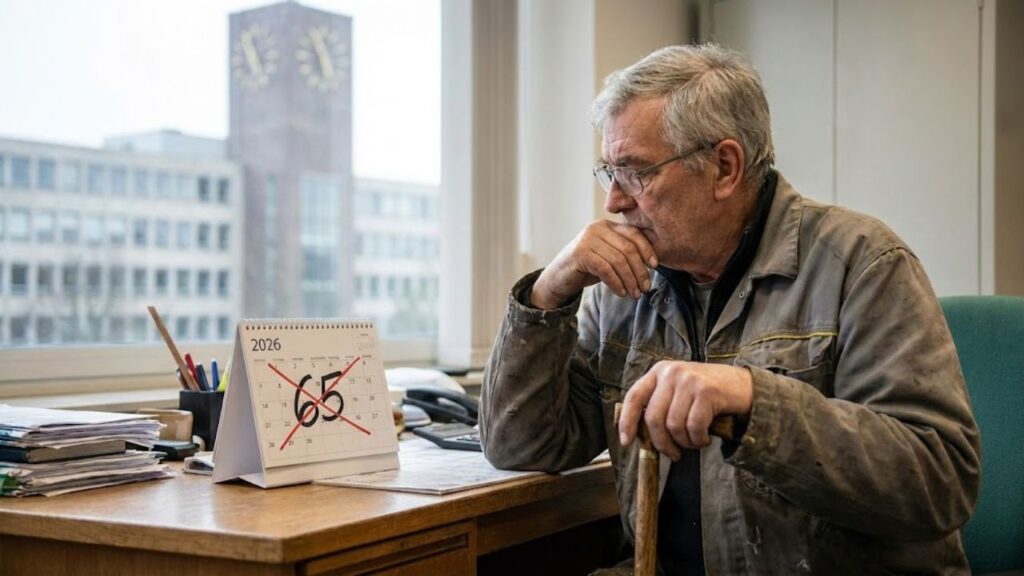

The idea of stopping work at 65 is being questioned as the United Kingdom reviews major pension changes planned for 2026. With longer life expectancy, shifting workforce needs, and rising public costs, authorities are reassessing how and when people should transition out of full-time employment. These proposed changes could affect millions who are planning their later years around traditional retirement timelines. While nothing is final yet, the discussion signals a clear move toward reshaping how retirement works in the UK.

Retirement at 65 May No Longer Be the Norm

For decades, 65 has symbolized the end of working life, but that expectation is now under review. UK authorities are examining whether the current system reflects modern realities, including healthier ageing and longer careers. A possible retirement age shift could encourage people to remain economically active for longer, especially in less physically demanding roles. Supporters argue this reflects longer working lives already happening in practice. Critics, however, worry about fairness for those in demanding jobs. The ongoing policy review aims to balance economic needs with personal wellbeing.

How Pension Rule Changes Could Affect Eligibility

One of the biggest concerns is how revised rules might alter access to state support. Any increase in the pension eligibility age would directly affect when individuals can start receiving payments. This could delay state pension access for future retirees, requiring more years of employment or private savings. For many households, this creates uncertainty around budgets and timelines. The changes may also influence career planning impact, pushing workers to rethink training, job changes, or phased retirement options well before reaching their sixties.

How to make a rich, restaurant-quality pasta sauce at home using only 4 simple ingredients

How to make a rich, restaurant-quality pasta sauce at home using only 4 simple ingredients

Why Authorities Are Rethinking the Pension System

The review is largely driven by economic realities rather than ideology. Maintaining pension payouts for a growing retiree population presents challenges to public finances. Authorities point to financial sustainability goals as a key reason for reform. Rising life expectancy and ageing population pressure mean fewer workers supporting more retirees. Adjusting retirement norms is seen as one way to protect the system while keeping a healthy labour market balance that supports growth and productivity.

What These Changes Mean for Future Retirees

While the debate continues, individuals are being encouraged to think ahead. Planning for future retirement planning may now require more flexibility than before. Experts suggest reviewing personal savings strategies and staying informed about official updates. Authorities have indicated that any reforms would include government transition measures to give people time to adapt. Even so, the conversation marks a shift in how retirement is viewed, moving away from a fixed age toward a more gradual, personalized transition.

| Aspect | Current System | Proposed Direction |

|---|---|---|

| Retirement Age | 65–66 years | Gradual increase |

| Pension Access | Fixed age-based | Later eligibility |

| Work Expectations | Full exit at retirement | Flexible or phased |

| Financial Planning | Shorter horizon | Longer preparation |

Frequently Asked Questions (FAQs)

1. Is retirement at 65 officially ending?

No, authorities are reviewing changes, but no final decision has been made yet.

Botox bob: here’s the haircut that makes you look “10 years younger” according to a hairstylist

Botox bob: here’s the haircut that makes you look “10 years younger” according to a hairstylist

2. When could the new pension rules take effect?

Any approved changes are expected to apply from 2026 onward.

3. Will current retirees be affected?

Existing retirees are unlikely to see changes to their current benefits.

4. What should future retirees do now?

They should monitor updates and consider flexible retirement planning.